Studying Time: 4 minutes

The warmth is actually on for Chancellor Jeremy Hunt and the Conservative social gathering. Right now’s Spring Finances set out the federal government’s plans for tax and spending over the approaching 12 months.

Inflation

“figures present that forecasts from OBR say inflation was 11% when he and Rishi Sunak took workplace (not mentioning that that was after various years of Conservative authorities.)

The most recent figures present inflation at 4%, and the OBR forecasts present it falling under the two% goal in ‘just some months time’ – a 12 months sooner than forecast within the autumn assertion. Nevertheless, it’s simple for the Chancellor to say this. Presently mortgage charges are going up with signifies that lenders assume inflation, and therefor rates of interest, will keep excessive for some time. We are going to see in just a few months time if the Chancellor is correct or simply ‘speaking the speak’.

Debt Help

Abolition of £90 cost for a debt aid order

For folks taking advance loans, he’ll enhance the reimbursement programme from 12 months to 24 months, he says.

For some folks a Debt Aid Order will assist. However they value £90, he says. He’ll abolish that cost.

Jasmine Birtles says “because the patron of the debt charity Neighborhood Cash Recommendation, I’m more than happy to see this silly cost dropped. Proper now there are millions of folks needing a Debt Aid Order and lots of can’t get one as they don’t have any cash…in fact! So scrapping that is an apparent and useful transfer.”

Obligation Freeze

Alcohol Obligation Freeze has been prolonged

Gas

Hunt claims that “if I did nothing gasoline obligation would elevate by 13%” by not doing this and providing a freeze he’s claiming motion however is in truth doing nothing.

VAT Modifications

Tens of hundreds of companies won’t have to pay VAT from April as the edge at which they need to cost VAT will go up from £85,000 to £95,000. Mr Hunt says that that is the primary enhance in seven years.

New British ISA

And the federal government will introduce a brand new “British ISA”, permitting investments of an additional £5,000 in British companies. This ISA allowance might be on high of the prevailing one.

Its focus might be solely on UK property. Michael Summergill chief government of AJ Bell say that The brand new British ISA is doomed to fail in these aims – UK retail buyers are already placing 50% of their ISA investments into UK property so the extra allowance won’t change investor behaviour” they go on to say that “The goal is laudable, however the British ISA is just the fallacious technique to obtain it. If the goal is to spice up funding in UK firms, the reply lies elsewhere. For instance, extending the prevailing AIM exemption from stamp obligation and/or inheritance tax to a wider pool of UK property would even have a significant influence.”

NHS Productiveness

The federal government claims it should slash the 13m hours misplaced by docs and nurses yearly to outdated IT methods. “AI might be used to chop down kind filling and working theatre processes might be digitised”

The Chancellor claimed that antiquated methods delay care. He added: “We are going to slash the 13 million hours misplaced by docs and nurses yearly to outdated IT methods. We are going to use AI to chop down and probably lower in half kind filling by docs. We are going to digitise working theatre processes permitting the identical variety of consultants to do an additional 200,000 operations a 12 months.

Baby Profit

Mr Hunt introduced an increase within the threshold at which oldsters begin paying the Excessive Earnings Baby Profit Cost, from £50,000 to £60,000. Making nearly half one million households higher off by a median of just about £1300 per family.

Taxes

There might be a brand new tax on vaping merchandise from October 2026 and in addition enhance in tobacco taxes.

Tax aid on vacation lettings might be unfrozen to enhance availability for long run letting.

Windfall tax will even be prolonged for power firms.

Air Passenger Obligation on non-economy flights will go up.

Earnings Tax Reduce by 2p

From April 6 NI might be lower by 2p. From 10% to eight% and self-employed NICS from 8% to six%.

Hunt claims, mixed with the adjustments introduced within the autumn assertion, 27 million folks will acquire £900. And a couple of million self-employed folks will acquire £650, the bottom tax since 1975 (Editor‘s notice: despite a completely totally different taxation system in 1975 and VAT not even present but).

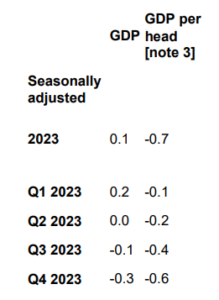

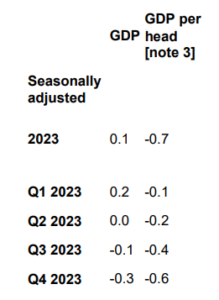

He says the OBR says this may put 200,000 extra folks in work. And it’ll enhance GDP by 0.4%, he says.

The charity Turn2Us commented that “The discount in Nationwide Insurance coverage won’t profit these on the bottom incomes. What we want is a complete overhaul of the connection between our welfare system and its beneficiaries. Such reform ought to start with adjusting advantages to adequately cowl important dwelling prices and abolishing punitive, ineffective measures just like the two-child restrict and sanctions.”

Taxing non-doms

From April 25 new arrivals to the UK won’t pay any tax in first 4 years. After 4 years those that proceed to reside right here pays the identical tax as different UK residents.

Jasmine Birtles says:

“Truthfully, I don’t suppose that something Jeremy Hunt says in his Finances will swing the election within the Conservatives’ favour. He may costume up as Santa and distribute sweets for the subsequent six months and it wouldn’t assist! Nevertheless, I might have anticipated extra and bolder acts to enhance our financial system. He mentioned himself, when reducing the upper price of capital positive factors on property gross sales, that decrease taxes would deliver in additional income as a result of it could enhance gross sales. Nicely, an analogous factor occurs with revenue tax the place folks spend extra within the financial system and in addition work more durable as a result of they are going to be capable of hold extra of the cash they earn. I do know that elevating the revenue tax thresholds makes an preliminary massive loss in tax income however it’s shortly changed by further revenues from elevated productiveness. Tinkering with NI funds gained’t lower it. We’d like daring strikes beginning with elevating the revenue tax thresholds.”