A authorities can not run steady fiscal deficits! Sure it may well. How? It’s worthwhile to perceive what a deficit is and the way it arises to reply that. However isn’t a fiscal surplus the norm that governments ought to aspire to? Why body the query that means? Why not inquire into and perceive that it’s all about context? What do you imply, context? The state of affairs is apparent, if it runs deficits it has to fund itself with debt, and that turns into harmful, doesn’t it? It doesn’t ‘fund’ itself with debt and to assume which means you don’t perceive elemental traits of the forex that the governments points as a monopoly. These claims about steady deficits and debt financing are made recurrently at varied ranges in society – on the household dinner desk, throughout elections, within the media, and nearly in every single place else the place we talk about governments. Maybe they aren’t articulated with finesse however they’re always being rehearsed and the responses I supplied above to them are principally not understood and which means coverage selections are distorted and infrequently the worst coverage choices are taken. So, whereas I’ve written extensively about these issues prior to now, I believe it’s time for a refresh – and the motivation was a dialog I had yesterday about one other dialog that I don’t care to reveal. But it surely instructed me that there’s nonetheless plenty of work to be achieved to even get MMT onto the beginning line.

Contemplate the US federal authorities, for instance.

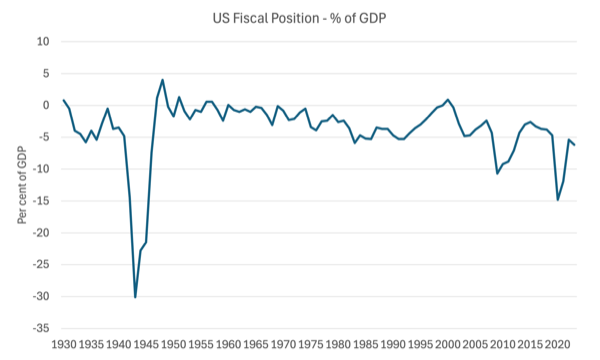

The next graph reveals the fiscal place for the US authorities from 1930 to 2023 as a per cent of GDP.

What do you observe?

The – historic knowledge – reveals that between 1930 and 2023, the US authorities ran deficits in 81 of these 95 years – or 85.2 per cent of the time.

And the opposite truth is that every time, the fiscal stability went into or near surplus, an financial contraction adopted quickly after.

That knowledge is indeniable.

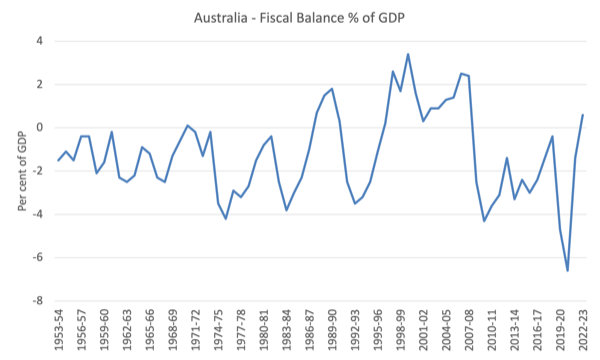

Take a look on the Australian federal knowledge (obtainable HERE).

The next graph reveals the fiscal place for the US authorities from 1953-54 to 2022-2023 as a per cent of GDP.

The info presently supplied by the federal government goes again to 1970-71, however the RBA additionally supplies some historic knowledge that enables us to return to 1953-54.

What you see is usually deficits.

Within the late Eighties, when the then Labor authorities turned obsessive about neoliberalism and the sanctity of surpluses, they recorded 4 years of surpluses which ended within the worst recession because the Nice Melancholy of the Nineteen Thirties.

From 1996, the Conservative authorities, equally obsessed, recorded consecutive surpluses till they had been thrown out of workplace in 2007.

That temporary interval in our historical past has been held out by commentators because the ‘norm’.

However because the graph reveals, it was an distinctive interval in Australian authorities monetary historical past.

And furthermore, it coincided with the large construct up in family debt – from 51.4 per cent of disposable earnings in 1996 to 163.5 per cent by the point they left workplace in 2007.

That ratio is now round 186 per cent as governments proceed to pursue austerity.

And we should always perceive that the 2 happenings – the fiscal surpluses and the rise in family debt – are intrinsically associated.

The pursuit of fiscal surpluses from 1996 coincided with intensive monetary market deregulation which noticed an explosion of financial institution credit score being absorbed by the family sector.

This was additionally a time that actual wages progress was being suppressed via harsh industrial relations laws designed to kill off commerce unions and shift the stability of energy firmly in favour of the employers.

The purpose is that the one means these fiscal surpluses had been capable of be recorded over the prolonged interval (barely over a decade) was as a result of financial progress (and the ensuing tax income progress) was maintained by the rise in family sector indebtedness, which allowed households who had been being squeezed by the fiscal austerity and the true wages suppression to take care of progress in family consumption expenditure.

Had the households not constructed up that debt and used credit score to take care of their expenditure progress, the financial system would have tanked badly a yr or so after the primary surplus was recorded in 1996-97 and the fiscal place would have shifted again into deficit fast good.

The opposite level to understand is that basing a progress technique on fiscal surpluses and ever rising indebtedness of the non-government sector is unsustainable as we noticed when the GFC hit.

Households, specifically, can not proceed indefinitely to build up ever rising ranges of indebtedness.

Finally, the stability sheet positions change into so precarious that minor shifts in financial fortune – similar to an increase in unemployment, a lack of informal working hours, or a rise in rates of interest – sends the sector into disaster and minimize backs in expenditure progress comply with quickly after.

These cutbacks plunge the financial system into recession, which is accentuated by the construct up of fiscal drag ensuing from the surpluses.

Those that attempt to characterise that interval of Australian historical past because the ‘norm’ which all different outcomes must be judged towards utterly misunderstand these relationships and dynamics.

The ‘norm’ for Australia is characterised by fiscal deficits.

The info reveals that between 1953-54 to 2022-2023, the Australian ran deficits for 52 of the 74 years or 74 per cent of the time.

If we excluded the ‘irregular’ years when family debt was rising dramatically and the family saving ratio plunged under zero, then that proportion rises to 90 per cent of the ‘regular’ time since 1953-54.

So what about context

The macroeconomic sectors are interlinked – authorities, exterior and personal home.

The web spending choices and outcomes of every reverberate on the others.

This permits us to know the context wherein fiscal coverage have to be framed.

For instance, in Australia’s case, as a capital importing nation, our exterior stability is often in deficit – which implies there’s a web spending drain from the native financial system to the remainder of the world.

That implies that a few of the earnings that the financial system produces every interval is misplaced to the home spending stream – it leaks out to the remainder of the world.

That leakage has been, on common round 3 to three.5 per cent of GDP because the Nineteen Seventies.

What are the implications of that?

First, if the non-public home sector (households and companies) want to avoid wasting total, then the federal government sector should goal fiscal deficits or else a recession would comply with and the fiscal place will probably be pressured into deficit.

Instance:

1. Exterior leakage 3.5 per cent of GDP.

2. Non-public home leakage (from total saving) 2 per cent of GDP.

3. For nationwide earnings to stay unchanged, the fiscal place should no less than offset these leakages with a commensurate injection of web spending – that may be a deficit.

At any time when there may be an exterior deficit, the fiscal place should no less than equal that deficit or else the non-public home sector will probably be pressured into deficit and rising indebtedness.

That ought to assist you to perceive what represents the ‘norm’ for a nation.

Within the case of Norway, for instance, which presently has exterior surpluses through its oil and gasoline reserves, then it may well nonetheless expertise total non-public home saving with a fiscal surplus, with out compromising financial exercise and the supply of first-class public infrastructure and providers.

Their context is totally different as a result of the exterior sector supplies a web spending injection versus nations working exterior deficits which should offset the spending drain with home spending injections.

Funding by debt?

Think about a brand new nation emerges and the federal government pronounces it can use a brand new forex and that each one residents should now relinquish their tax liabilities utilizing that forex.

What turns into the issue?

Merely that the non-government sector, which makes use of the federal government’s forex, doesn’t have any of the brand new forex and can thus be unable to pay their tax liabilities, amongst different issues.

Answer?

The federal government spends the brand new forex into existence.

How?

Via procurement processes, pension funds and many others.

The non-government sector instantly has an incentive to provide its productive sources to the federal government with the intention to earn the brand new forex.

The sequence is apparent – new forex –> tax legal responsibility –> public spending –> tax funds.

Ought to the general public spending exceed tax funds then we report a fiscal deficit and the non-government sector has a stream of saving (within the new forex) which accumulates as a inventory of wealth.

That wealth was solely attainable as a result of the fiscal deficit occurred – that’s, the federal government didn’t tax away all its spending injection.

Now think about that the federal government pronounces a portfolio selection for the non-government sector: an interest-bearing bond (debt instrument) to switch the forex denominated wealth (from the prior saving).

The non-government sector now may convert a few of their forex wealth into interest-bearing bonds and the statistician would report a rise in nationwide debt.

However that might simply replicate the portfolio combine within the non-government sector between on this easy case forex holdings and interest-rate bond holdings.

The place did the funds come from that allowed the non-government sector to buy the federal government debt?

Reply: Prior financial savings amassed as forex wealth.

The place did that wealth come from?

Reply: Prior fiscal deficits – authorities spending not totally taxed away.

In different phrases, it was the fiscal deficits that supplied the funds for the non-government sector to buy the federal government debt.

On what planet would we assemble these dynamics and causalities because the ‘debt funding the deficits’?

The logic doesn’t change once we complicate the story with actual world establishments and behaviours.

Governments don’t must difficulty debt with the intention to run fiscal deficits.

The debt issuance doesn’t fund the federal government deficits.

Mainstream economists say that if the debt shouldn’t be issued there can be accelerating inflation – their so-called ‘cash printing’ case which they eschew.

However that can also be nonsensical as a rule.

Given we perceive the choice to buy the federal government debt is a portfolio selection on desired combine of various parts of the wealth holdings within the non-government sector, it must be clear that the ‘funds’ weren’t going to be spent into the financial system anyway.

And if the fiscal deficit injection pushed whole expenditure past the capability of the financial system to reply (from the supply-side) by rising manufacturing, then we’d think about that an imprudent coverage place, however, equally, one that’s simple to alter – minimize the growth.

Conclusion

The rules are clear:

1. Governments can run steady fiscal deficits without end and the specified magnitude will depend upon the context.

2. Governments which difficulty their very own forex don’t fund their deficits with debt issuance. The deficits, slightly, fund the capability of the non-government sector to web save, which then permits for wealth portfolio selections, which may embody the acquisition of presidency debt.

That’s sufficient for as we speak!

(c) Copyright 2024 William Mitchell. All Rights Reserved.