At the moment (August 28, 2024), the Australian Bureau of Statistics (ABS) launched the newest – Month-to-month Client Worth Index Indicator – for July 2024, which confirmed that the annual inflation fee has fallen from 3.8 per cent in June to three.5 per cent in July, a big decline which continues the downward pattern. That pattern has been interrupted over the previous few years by transitory components like climate occasions however it’s clear there’s not an extreme spending state of affairs current within the Australian economic system, which ought to finish all discuss of much more aggressive financial coverage (inside the mainstream logic). The month-to-month inflation fee was zero in July even when we have a look at the All Teams CPI excluding unstable gadgets (that are gadgets that fluctuate up and down commonly on account of pure disasters, sudden occasions like OPEC value hikes, and so forth). The final conclusion is that the worldwide components that drove the inflationary pressures are resolving and that the outlook for inflation is for continued decline. There may be additionally proof that the RBA has precipitated among the persistence within the inflation fee via the influence of the rate of interest hikes on enterprise prices and rental lodging.

The newest month-to-month ABS CPI information exhibits for July 2024 that the annual outcomes are:

- The All teams CPI measure rose 3.5 per cent over the 12 months (down from 3.8 in June).

- Meals and non-alcoholic drinks 3.8 per cent (from 3.3).

- Clothes and footwear 1.9 per cent (3.6).

- Housing 4.0 per cent (5.5). Rents (6.9 per cent cf. 7.1 per cent).

- Furnishings and family tools -0.9 per cent (-1.1).

- Well being 5.3 per cent (5.3).

- Transport 3.4 per cent (4.2).

- Communications 1.9 per cent (1.0).

- Recreation and tradition 1.1 per cent (from 0.6).

- Schooling 5.6 per cent (5.6).

- Insurance coverage and monetary providers regular at 6.4 per cent.

The ABS Media Launch (August 28, 2024) – Month-to-month CPI indicator rose 3.5% within the 12 months to July 2024 – famous that:

The month-to-month Client Worth Index (CPI) indicator rose 3.5 per cent within the 12 months to July 2024, down from 3.8 per cent in June …

Essentially the most important contributors to the annual rise have been Housing (+4.0 per cent), Meals and non-alcoholic drinks (+3.8 per cent), Alcohol and tobacco (+7.2 per cent), and Transport (+3.4 per cent) …

Housing rose 4.0 per cent within the 12 months to July, down from 5.5 per cent in June. Rents elevated 6.9 per cent for the 12 months to July, down from an increase of seven.1 per cent within the 12 months to June …

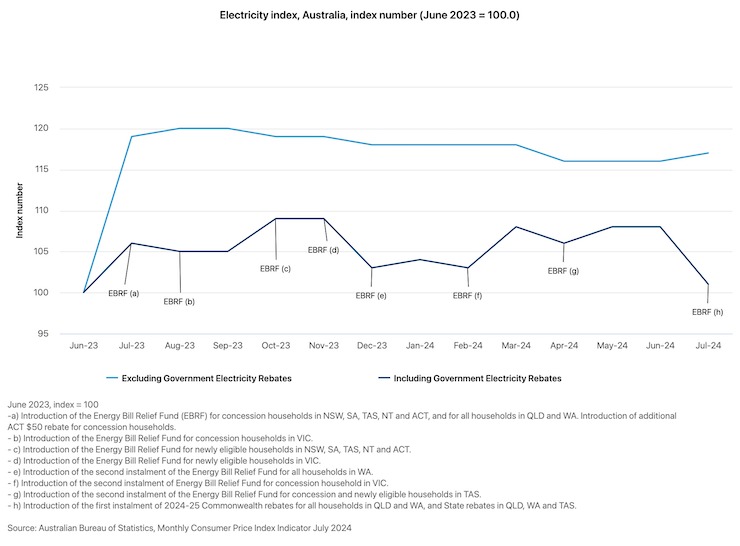

The decrease improve in Housing for the 12 months to July was primarily on account of falls in costs for electrical energy. Electrical energy costs fell 5.1 per cent within the 12 months to July, down from an increase of seven.5 per cent in June. The introduction of latest Commonwealth and State rebates drove the autumn in July …

Altogether these rebates led to a 6.4 per cent fall within the month of July. Excluding the rebates, Electrical energy costs would have risen 0.9 per cent in July …

So a couple of observations:

1. It’s now clear that the CPI Indicator is falling and the month-to-month change between June and July was zero.

2. If we have a look at the All Teams CPI excluding unstable gadgets (that are gadgets that fluctuate up and down commonly on account of pure disasters, sudden occasions like OPEC value hikes, and so forth) then the month-to-month inflation fee was additionally zero per cent.

3. The lease inflation is partly as a result of RBA’s personal fee hikes as landlords in a decent housing market simply go on the upper borrowing prices – so the so-called inflation-fighting fee hikes are literally driving inflation.

6. The electrical energy part is considerably decrease after the introduction of the federal and state authorities rebates offsetting the profit-gouging within the power sector. Expansionary fiscal coverage may be an efficient device in combatting inflation.

7. The primary drivers of the present inflation state of affairs will not be demonstrating any sensitivity to the RBA’s rate of interest modifications.

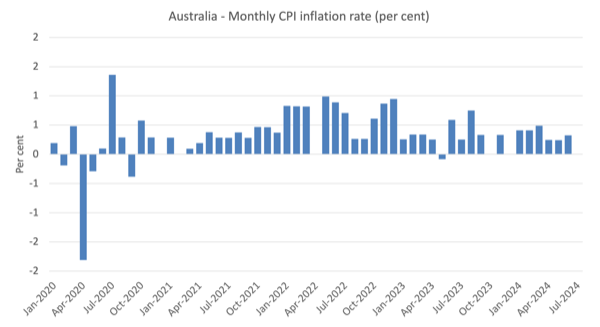

The following graph exhibits the month-to-month fee of inflation which fluctuates in step with particular occasions or changes (similar to, seasonal pure disasters, annual indexing preparations and so forth).

There isn’t a trace from this information that the inflation fee is accelerating or wants any particular coverage consideration..

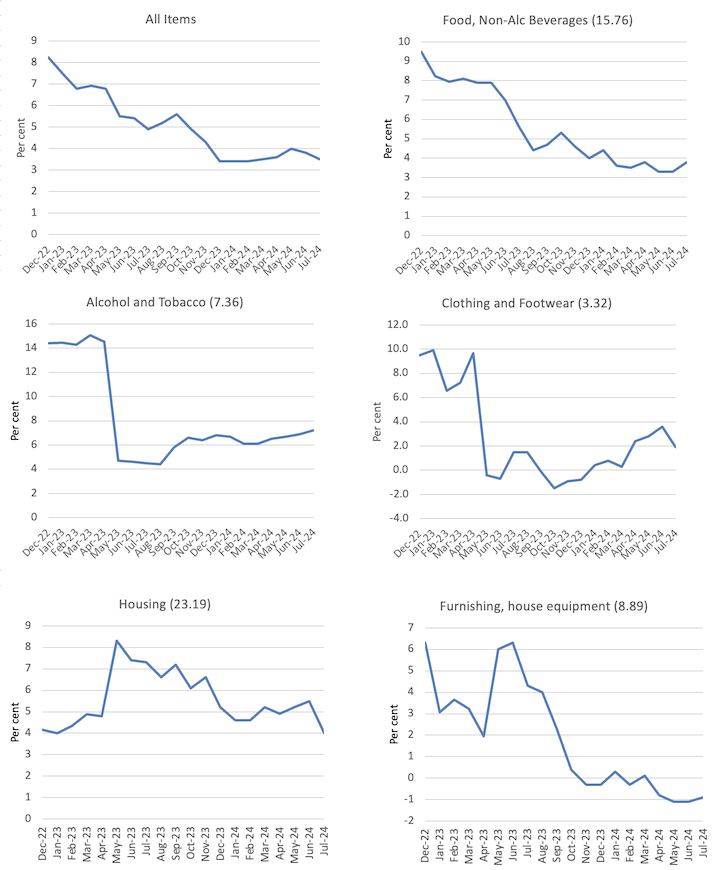

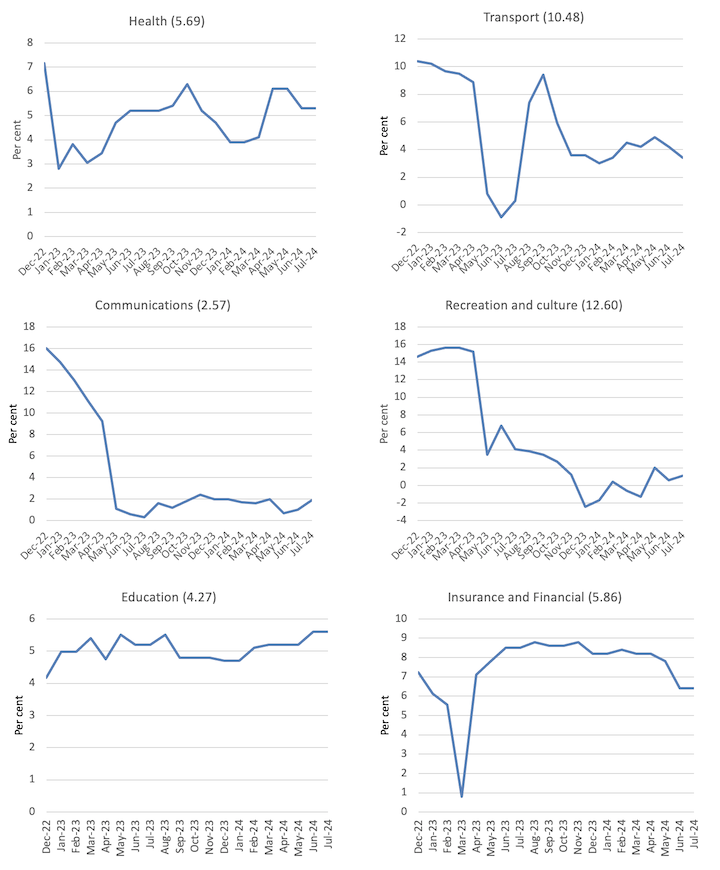

The following graphs present the actions between December 2022 and July 2024 for the principle parts of the All Gadgets CPI (the decimal numbers subsequent to the part title is the load of that part within the general CPI the place the sum is 100).

On the whole, most parts are seeing dramatic reductions in value rises as famous above and the exceptions don’t present the RBA with any justification for additional rate of interest rises.

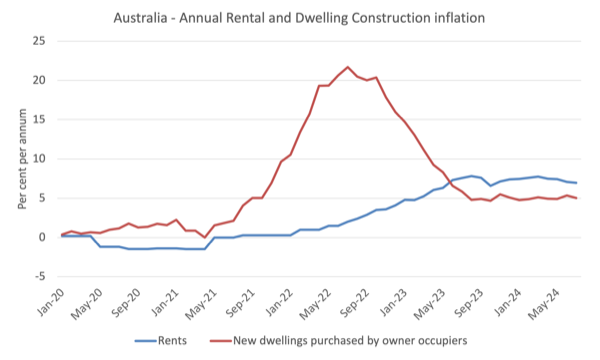

The following graph exhibits the actions within the housing part (with rents separated out from the brand new dwelling buy by owner-occupiers.

The lease part has risen virtually in sync with the RBA rate of interest hikes and now the speed hikes have ended (for now), the lease inflation has levelled off.

The development prices for brand spanking new dwellings have been in retreat since early 2022 as the availability constraints arising from pure disasters (fireplace burning down forests), the pandemic (constructing provide disruptions), and the Ukraine state of affairs have eased.

The ABS additionally revealed an fascinating graph, which compares the electrical energy costs below the Federal authorities’s – Vitality Invoice Aid Fund – rebates which have been launched in July 2023 and what they might have been within the absence of that fiscal intervention.

The Aid Fund offered subsidies to households and small companies relying on the locality.

For instance, a Victorian family was given a rebate of $250.

The ABS report that with out the rebates “Excluding the rebates, Electrical energy costs would have risen 0.9 per cent in July”.

Right here is the influence of that straightforward and really modest scheme.

It demonstrates that targetted expansionary fiscal coverage can certainly be anti-inflationary, which signifies that the spending-inflation nexus isn’t simple because the mainstream narratives might need you consider.

Guide Occasion – Melbourne, September 12, 2024

Readings Bookshop in Melbourne is internet hosting an occasion – Invoice Mitchell with Alan Kohler – which shall be held on the Hawthorn Store (687 Glenferrie Rd, Hawthorn, Victoria, 3122) on Thursday, September 12, beginning at 18:30.

I shall be there with ABC Finance persona Alan Kohler to debate my new e-book (co-authored by Warren Mosler) – Fashionable Financial Idea: Invoice and Warren’s Glorious Journey.

Copies of the e-book shall be out there at low cost costs and my pen would possibly come out if you need it signed.

Readings have elevated the capability for the occasion, after their ordinary viewers measurement was oversubscribed.

The occasion is free however you want to e-book a ticket.

Yow will discover extra particulars and reserving data – HERE.

Music – for travelling

Generally you want to actually focus on a brand new album and play it a number of instances to understand the nuances and subtlety of the efficiency by the artist(s) and the mastering by the producer.

Simply such an album is – Voices – by the put up minimalist composer – Max Richter.

It was launched on July 31, 2020 and was “impressed by the Common Declaration of Human Rights”.

This text (June 25, 2020) – Max Richter Declares New Album ‘Voices’ – supplies some background about how the readings have been organised and sourced.

The album has a voiced part (with varied readings) after which the unvoiced model of the music.

The complete album makes use of what Max Richter refers to as a “unfavorable orchestra” (“almost all basses and cellos”).

At some phases within the album you assume you hear a deep rumbling – one of many deepest sound the human ear can hear I believe – and it’s a very stark background to the unfavorable orchestra.

The entire album is 56 minutes then repeats in unvoiced mode.

My favorite monitor is Mercy with the solo violin performed by – Mari Samuelson.

Right here it’s.

Here’s a brief video from Max Richter explaining the motivation of the album and its that means.

He at all times has a really sound and progressive intent behind his music.

He commented on the album:

I like the concept of a bit of music as a spot to assume, and it’s clear all of us have some pondering to do for the time being. The Common Declaration of Human Rights is one thing that provides us a means ahead. Though it isn’t an ideal doc, the declaration does symbolize an inspiring imaginative and prescient for the potential for higher and kinder world.

He goes additional on this NPR interview (August 2, 2020) – Composer Max Richter On ‘Voices,’ A New Album That Envisions A Higher World.

Here’s a overview of the album from British Gramophone – Richter Voices.

That’s sufficient for as we speak!

(c) Copyright 2024 William Mitchell. All Rights Reserved.