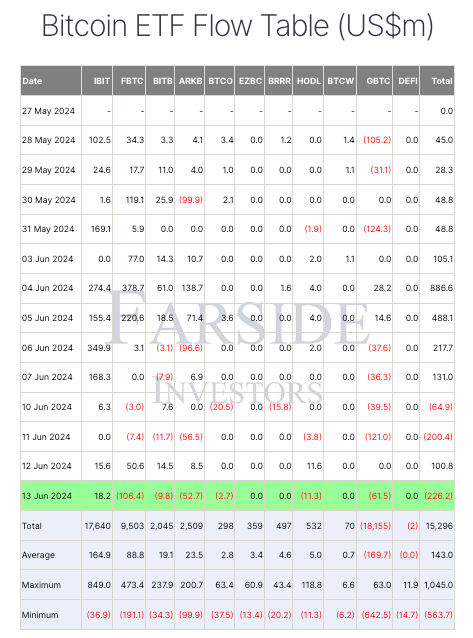

After a profitable Wednesday, spot Bitcoin ETFs noticed one other vital downturn yesterday. Based on knowledge from Farside, June 13 noticed outflows totaling $226.2 million, contrasting sharply with the $100.8 million recorded on June 12.

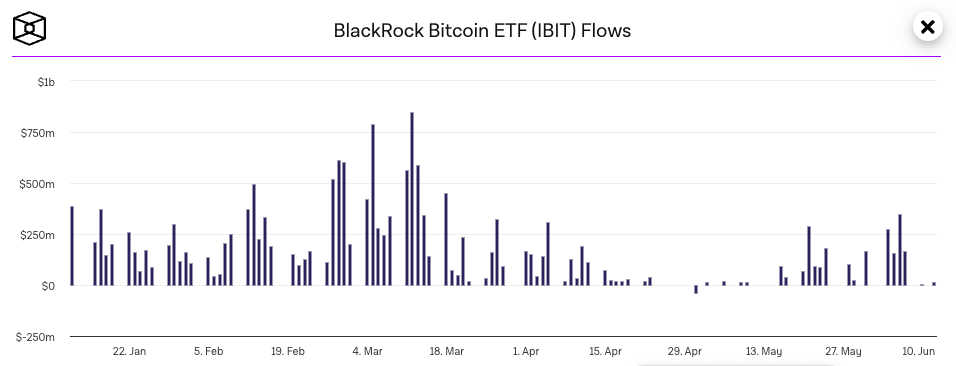

Constancy’s FBTC led the outflows with $106.4 million. That is the best outflow FBTC has seen prior to now month and a pointy pattern reversal from the $50.6 million influx it noticed on June 12. Grayscale’s GBTC ranked second with $61.5 million in outflows, adopted by Ark’s ARKB’s $52.7 million outflow. Solely BlackRock’s IBIT noticed inflows yesterday, totaling $18.2 million.

This continues the 44-day streak of steady inflows to IBIT. IBIT’s observe file of inflows has solely damaged since its launch. On Might 1, IBIT recorded $36.9 million in outflows.

The huge discrepancy between Wednesday’s inflows and yesterday’s outflows might, not less than partly, be attributed to the volatility throughout the broader market. This volatility was a results of the newest information coming from the SEC, which acknowledged that the primary spot Ethereum ETFs shall be authorised this summer time.

Whereas market analysts doubt that ETH ETFs would garner the identical institutional consideration, the brand new product would undoubtedly draw some quantity from Bitcoin ETF. The truth that the Bitcoin ETF market has thus far reacted with vital outflows on rumors and information about ETH ETFs additional confirms this.