It’s Wednesday and I’m principally interested by Japan at the moment. In simply over every week’s time, I’ll as soon as once more head to Japan to work at Kyoto College. I will likely be there for a number of weeks and can present common stories as I’ve in earlier years of what’s occurring there. The LDP management battle is definitely proving to be attention-grabbing and there may be now a view rising that the hoped for escape from the deflationary interval has not occurred and additional fiscal growth is critical. That is at a time when the yen is appreciating and the authorities are frightened it’s making the exterior sector noncompetitive. That’s, gentle years away from the predictions made by the ‘MMT is useless’ crowd once they noticed the depreciating yen throughout 2022 and past. It simply goes to indicate that making an attempt to interpret the world from the ‘sound finance’ lens will usually result in inaccurate conclusions.

The yen

I don’t spend a lot time following Twitter exchanges and fewer now that it has turn out to be reasonably unhinged.

However I do discover some issues.

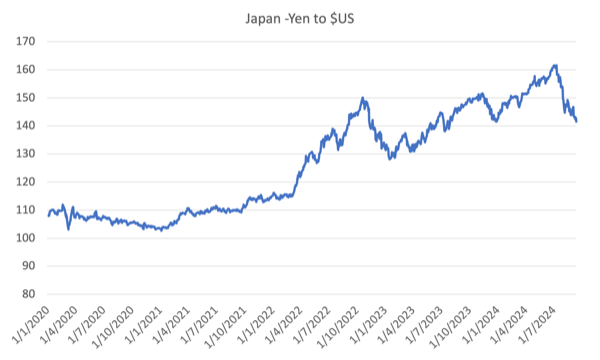

The yen began depreciating in March 2022, proper after the US Federal Reserve Financial institution began climbing the Federal Funds fee.

Whereas the remainder of the central banks around the globe hiked rates of interest to various levels, the Financial institution of Japan held its fee fixed at minus 0.1 per cent.

Additionally they maintained management of the bond markets via their Yield-Curve-Management (YCC) coverage to maintain authorities bond charges steady throughout the yield (maturity) curve.

Their justification for this coverage stance was two-fold.

First, they adopted the view that the foremost elements driving the inflation had been transitory and associated to the provision aspect constraints that the pandemic induced, the Russian incursion into the Ukraine after which the OPEC+ oil worth rises.

Second, they had been actively making an attempt to handle an escape from the deflationary cycle the nation had been trapped in for some years. In different phrases, they had been completely satisfied to see inflation fall however wished to stabilise it round 2 per cent.

The Financial institution’s technique signifies that they continue to be throughout the mainstream paradigm, which considers that decrease rates of interest present a stimulus.

And that, coupled with fiscal accountability motives driving the gross sales tax will increase, has stored a lid on home demand and costs, in the end supporting commerce surpluses, which have been returning.

The yen continued to depreciate via to October 2022 after which reversed course for a number of months into 2023 as the next graph reveals.

Then an extended interval of pattern depreciation (that’s weakening yen with occasional strengthening intervals) got here to a peak in July 2024.

All through this era, I noticed the same old suspects crowing loudly on Twitter and elsewhere (if one can crow on social media platforms) about how the day of reckoning for Fashionable Financial Principle (MMT) has arrived and the poster youngster Japan is now dealing with the truth of enormous, steady deficits, vital excellent public debt, and enormous bond-buying by the Financial institution of Japan.

Apparently, the depreciating alternate fee marked the start of the judgement interval by monetary markets and demonstrated their capability to destroy a forex if the federal government was not compliant to the rules of sound finance.

The buy-in by others on social media of that view was substantial.

All types of gobs had been speaking massive and announcing the tip of MMT.

See, we advised you so kind of stuff, you idiots.

I acquired many E-mails throughout that interval concerning the obvious reckoning for MMT – none had been complimentary and all simply went into the delete bin and not using a reply from me.

The mainstream ‘consultants’ thought they’d lastly discovered a brand new entrance upon which they’ll debunk MMT.

Apparently, the depreciation proves that Japan’s persevering with fiscal deficits and the excessive public debt ratio are being rejected by the monetary markets.

In response to this narrative the Financial institution of Japan has no alternative however to place a cap on bond yields and hold rates of interest low or else the debt servicing will turn out to be inconceivable.

This results in the conclusion that MMT is incorrect as a result of there’s a monetary market constraint on how far fiscal authorities can go.

As we clarify in our new e book – Fashionable Financial Principle: Invoice and Warren’s Wonderful Journey – the forex trajectory was pushed principally by the commerce account.

An MMT understanding would clearly result in an expectation that the yen would have depreciated due to the differential between the Japanese rates of interest and people obtainable elsewhere has risen, which has inspired an outflow of investments from yen. Additional the swings within the commerce steadiness as world occasions change has been influential.

The depreciation offers no ‘check’ of the validity of MMT as a superior lens to grasp the way in which the fiat financial system works.

Now, what’s the story since August?

Nicely the Twitter heroes have gone silent about their claimed hyperlink between the yen alternate parity and MMT.

After all they’ve.

There was a narrative within the Japan Occasions yesterday (September 17, 2024) – Japan set to carry charges regular as yen rallies and LDP candidates stump (you might want to be a subscriber to learn it) – which means that the Financial institution of Japan won’t be climbing charges at its assembly later this week.

The heroes additionally claimed that the Financial institution of Japan must hold pushing charges up persistently after their first hike in March 2024 to keep away from additional depreciation and forex Armageddon.

However the authorities are actually frightened that the yen’s appreciation is extreme and undermining its buying and selling place via the phrases of commerce.

The purpose is that the Japanese expertise demonstrates how ridiculous these pronouncements (‘MMT is useless’) actually are.

In contrast to central bankers elsewhere who had drummed up the inflation bogey as justification for climbing charges, the Financial institution of Japan officers noticed a ‘virtuous cycle between wages and costs’ rising which might underpin a normalisation of the inflation fee at round 2 per cent.

However they thought-about the outlook to be unsure and thus made it clear that they might ‘patiently proceed with financial easing beneath the framework of yield curve management, aiming to assist Japan’s financial exercise and thereby facilitate a positive surroundings for wage will increase’ in response to the Financial institution of Japan governor Ueda Kazuo who gave a speech on November 6, 2023 in Nagoya to enterprise leaders – Japan’s Economic system and Financial Coverage.

The Financial institution’s decision-making is dominated by what it thinks will occur to wages annually because of the so-called ‘spring wage offensive’ or Shuntō, which is performed in February and March annually.

In 2023, the typical annual wage final result from the spring wage offensive was 3.8 per cent, which delivered very small actual buying energy will increase to staff, given the inflation fee of round 3.3 per cent.

The March estimate for the 2024 spherical was 5.28 per cent at a time when inflation had continued to fall.

The wage outcomes for 2024 will thus see staff take pleasure in a major actual wage enhance in Japan.

Nevertheless, the actual beneficial properties had been too little too late to avoid wasting Fumio Kishida’s Prime Minister ship, particularly with different scandals persevering with to run.

Partly, for this reason he introduced he wouldn’t run for re-election because the LDP chief (and therefore Prime Minister).

The Financial institution of Japan has lengthy indicated that when it was clearer that the interval of suppressed Shuntō wage outcomes was coming to an finish, then they might begin to enhance rates of interest.

And that’s what they did.

The Financial institution hoped that the wage actions are indicative of a shift in mindset in Japan from a deflationary bias to a extra normalised surroundings the place shopper demand can drive financial development through stronger wage contributions.

The minimal fee rise was under no circumstances an indication that the Financial institution was giving in to monetary market stress or was lastly falling into line with the remainder of the central banks.

Nevertheless, the Shuntō outcomes actually are concerning the wage negotiations between the commerce unions and the massive employers.

They take some months to filter right down to the smaller companies in Japan, which dominate.

And the proof that we now have obtainable is that the actual wage boosts that had been hoped for throughout the board haven’t eventuated.

And with out these boosts to the actual buying energy, Japanese customers have declined to increase their spending and that has put a brake on any hoped for growth of the Japanese development fee.

The latest knowledge is extra hopeful on the family consumption entrance as actual wages appear to be exhibiting constructive indicators.

And the debates among the many LDP management contenders consists of discuss of resisting any additional tightening of rates of interest.

That is particularly the view from one of many favourites, Sanae Takaichi.

She has:

… additionally indicated that she will likely be rolling out insurance policies that embody aggressive fiscal spending financed by the sale of presidency bonds, which might make it powerful for the BOJ to lift charges.

I may announce that MMT is alive and effectively.

Fashionable Financial Principle: Invoice and Warren’s Wonderful Journey

We did an Australian launch final week in Melbourne with host ABC finance reporter Alan Kohler.

A video will likely be obtainable of that launch quickly.

You’ll be able to order the e book globally from the publishers web page for €14.00 (VAT included) – HERE.

Australian purchasers can get a duplicate for $A29.99 from – Readings Books – both at their Hawthorn or Carlton store or via their on-line retailer.

Music – Nostalgia (Tezeta)

That is what I’ve been listening to whereas working this morning.

Right here is the ‘father of Ethio-jazz’ – Mulatu Astatke – who is likely one of the nice vibraphone gamers (to not point out his abilities in conga drums, percussion and organ).

He’s not a giant identify in Western jazz however to me, he has been an actual pioneer and I really like the sequence of his albums from early Latin parts (picked up whereas finding out within the US) to his later work fusing pure African influences utilizing Ethiopian instrumentation (such because the chordophone or Krar).

In that later case, the usual pentatonic scale (the Krar is tuned to it) was an ideal method to combine extra Western devices into his fashion of jazz.

This music – Tezeta (Nostalgia) – is from the 1972 launch – Ethiopian Fashionable Instrumental Hits (launched Amha Data).

Amha Data – fled Ethiopia in 1975 after the army junta took over.

It was re-released on the 1998 quantity – Éthiopiques 4: Ethio Jazz & Musique Instrumentale 1969-1974 – (Buda information), which featured the music of Mulatu Astatke.

This CD remains to be obtainable.

Very mellow.

You’ll be able to study concerning the – Tizita – musical type in Ethiopia, which Westerners consider as blues music.

The shape makes use of the – Qenet – pentatonic scale

Right here is an attention-grabbing bio from 2018 – The daddy of Ethiopian jazz, Mulatu Astatke, stays a musician in movement.

That’s sufficient for at the moment!

(c) Copyright 2024 William Mitchell. All Rights Reserved.